Back to Main Page: www.VulcanInternational.blogspot.com

Thursday, December 8, 2011

118 at Island Plaza Penang - Invitation to actual show units available for viewing

Dear Buyers,

/------------------------------------------------------------------------------------\

Fact#2: Discounts: units 1-3A (hill view) 5%, units 8-12A (sea view) 3%.

Stamp duty & legal fee will be absorbed by developer *T&C apply. Starting tomorrow(9-Dec-2011 till 11-Dec-2011(Sunday). So don't let it slip through your hand. Number of units available are limited.

Do call Vulcan Lau, mobile: +6 016 451 1321 for appointment.

\------------------------------------------------------------------------------------/

Date: 09 - 11 DEC 2011(Fri - Sun)

I will be at Level 6 where the actual units are available for viewing on 10 - 11 DEC 2011(Sat - Sun) from 10am till 6pm. You could also check with me on its pricing.

Please give me a call (mobile: +6 016 451 1321) Vulcan Lau before you coming over for purchase so that I will be able to accommodate and assist you in your valuable purchase.

Looking forward to your call. This is a good investment and don't miss the opportunity to own one for yourself or to conduct your business.

Thank you.

Back to Main Page: www.VulcanInternational.blogspot.com

Sunday, December 4, 2011

Customer Feedback Form | Customer Survey - 2011/2012

Dear Valued Customer,

As we're coming toward end of 2011 year, we would be appreciated if you could spend a few minutes of your precious time to fill up our Customer Survey/Customer Feedback Form. We hope to serve you better and wishing you MERRY CHRISTMAS AND HAPPY NEW YEAR.

Please click the link below to fill up the form. Thank you.

http://www.surveymonkey.com/s/PWX88DW

As we're coming toward end of 2011 year, we would be appreciated if you could spend a few minutes of your precious time to fill up our Customer Survey/Customer Feedback Form. We hope to serve you better and wishing you MERRY CHRISTMAS AND HAPPY NEW YEAR.

Please click the link below to fill up the form. Thank you.

http://www.surveymonkey.com/s/PWX88DW

Back to Main Page: www.VulcanInternational.blogspot.com

Saturday, December 3, 2011

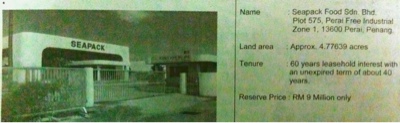

Auction Properties Malaysia | Penang Property Blog | Bank Lelong | Lelong Awam | Lelong Galeri | Auction House | Auction Property Penang | Auction Listing From Bank: Dec2011(H S)

Lists below are Penang auction properties from banks. It's now been placed under property for auction/Bank Lelong/Lelong Awam/Lelong Galeri. Take note on the Penang Property Blog auction date for the property that you're interested. In the case of property without auction date you need to call Vulcan Lau, mobile: +6 016 451 1321 .

No | Particular of the Property | Approved Reserve Price | No of Auction Fair (inclusive this) |

1 | 1-3A-29, Solok Semarak Api, 11500 | 44,700 | 5 |

2 | 2 bedroom flat bearing address No 1066-10-45, | 37,300 | 3 |

3 | A 2 bedroom flat bearing assessment address No. 2-18-8, Desa Mawar, Lintang Kampung Melayu 2, Bandar Baru Air Itam, 11500 | 60,000 | 2 |

4 | No. 1B-9-4, | 120,000 | 2 |

5 | No. 5-20-12A, Taman Bendera, Lintang Relau 1, 11900 | 52,700 | 7 |

6 | A 3 bedroom flat bearing assessment address 3B-16-5, Jalan Rumbia, | 120,000 | 1 |

7 | 2 Bedroom Flat bearing address No. Asoka-4-13, Mutiara Perdana, | 60,000 | 1 |

8 | 1-03-3A, Solok Kenari, Taman Sri Puteri, 11900 Bayan Lepas | 90,000 | 1 |

NO. | PROPERTY | AUCTION DATE | PROPERTY TYPE | BUILD-UP AREA / FLOOR AREA | TENURE (FREEHOLD / LEASEHOLD) | RESERVE PRICE (RM) |

1 | 1-G-2,TAMAN HUI AUN, HALAMAN ZOO SATU,11500 AIR ITAM, | 23-Feb-12 | STRATIFIED SHOPLOT | 65 SQM | FREEHOLD | 190,000.00 |

2 | 7A-09-11,DESA INTAN,LEBUHRAYA THEAN TEK, BANDAR BARU AYER ITAM,11500 PULAU | PENDING | 3 BEDROOM FLAT | 59SQM | LEASEHOLD | 76,950.00 |

3 | 1B-14-05, DESA DELIMA, LORONG SEMARAK API 2, BANDAR BARU AYER ITAM, 11500 PULAU | PENDING | 3 BEDROOM APARTMENT | 64 SQM | FREEHOLD | 117,000.00 |

4 | 7A-11-11, DESA INTAN, LEBUHRAYA THEAN TEIK, BANDAR BARU AYER ITAM, 11500 | PENDING | 3 BEDROOM FLAT | 59 SQM | FREEHOLD | 80,000.00 |

5 | 2C-13-09, | PENDING | 2 BEDROOM FLAT | 48 SQM | LEASEHOLD | 52,650.00 |

6 | 12-3-6,LENGKOK MAHSURI,BANDAR BAYAN BARU,11950 | 17-Jan-12 | 2 BEDROOM FLAT | 51 SQM | LEASEHOLD | 75,000.00 |

7 | 14-1-3, LENGKOK MAHSURI, BANDAR BAYAN BARU, 11950 | PENDING | TWO BEDROOM FLAT | 51 SQM | LEASEHOLD | 80,000.00 |

8 | 3-2-4, LENGKOK MAHSURI, BAYAN BARU, 11950 | PENDING | LOW COST WALK-UP FLAT | 51 SQM | LEASEHOLD EXPIRING 29.12.2079 | 70,000.00 |

9 | G-3-11,LORONG MAHSURI 10,BAYAN BARU,11950 BAYAN LEPAS, | 14-Dec-11 | 2 BEDROOM LOW COST WALK-UP FLAT | 49 SQM | LEASEHOLD | 70,000.00 |

10 | L-2-2, LORONG MAHSURI 11, BAYAN BARU 11950 BAYAN LEPAS, PULAU | PENDING | 2 BEDROOM LOW COST FLAT | 49 SQM | LEASEHOLD EXPIRING ON 01.05.2077 | 52,488.00 |

11 | 6A-5-10, PERSIARAN MAYANG PASIR 5, 11900 BAYAN LEPAS, | PENDING | 2 BEDROOM FLAT | 500 SQFT | LEASEHOLD EXPIRING 21.02.2082 | 52,650.00 |

12 | 4-5-1, SOLOK SUNGAI ARA SATU, SUNGAI ARA, 11900 BAYAN LEPAS, | PENDING | 2 BEDROOM LOW COST WALK UP FLAT | 50.3 SQM | LEASEHOLD EXPIRING 26 AUG 2082 | 60,750 |

13 | B-16-4, BUKIT GAMBIR,11900 BAYAN LEPAS, PULAU | PENDING | 2 BEDROOM FLAT | 56.2 SQM | FREEHOLD | 52,488.00 |

14 | 6-4-2,SOLOK SUNGAI ARA 1,SUNGAI ARA,11900 BAYAN LEPAS,PULAU | PENDING | 2 BEDROOM FLAT | 51 SQM | LEASEHOLD | 68,850.00 |

15 | 20,PINTASAN BAHAGIA 14,BANDAR BAYAN BARU,11950 BAYAN LEPAS, | PENDING | INTERMEDIATE DOUBLE STOREY CLUSTER | 69 SQM | LEASEHOLD | 120,000.00 |

16 | 1-3-3,LENGKOK MAHSURI,BAYAN BARU,11950 BAYAN LEPAS,PULAU | PENDING | 2 BEDROOM FLAT | 51 SQM | LEASEHOLD | 90,000.00 |

17 | 2-3-4, LENGKOK MAHSURI, BAYAN BARU, 11950 | PENDING | LOW COST WALK-UP FLAT | 51 SQM | LEASEHOLD 99 YEARS EXPIRING 29.12.2079 | 58,500.00 |

18 | 1-3-5,TAMAN PEKAKA,JALAN PEKAKA 2,11700 GELUGOR, | PENDING | 3 BEDROOM LOW COST WALK-UP FLAT | 61SQM | FREEHOLD | 70,000.00 |

19 | 16,LORONG SECK CHUAN,10200 | PENDING | AN INTERMEDIATE DOUBLE STOREY SHOP-HOUSE | 82.681SQM | FREEHOLD | 320,000.00 |

20 | 408-3-3,JALAN SELAMA,11600 JELUTONG,PULAU | PENDING | SHOP APARTMENT | 66SQM | FREEHOLD | 89,100.00 |

21 | 39-4-9, TINGKAT PAYA TERUBONG 4, MUKIM 13, 11060 | PENDING | 2 BEDROOM FLAT | 560 SQFT | LEASEHOLD EXPIRING 12.06.2086 | 52,650.00 |

22 | 9-3-2 TMN SRI ANGSANA, LEBUH RELAU 3, 11900 | 14-Dec-11 | 3 BEDROOMS APARTMENT | 64 SQM | FREEHOLD | 140,000.00 |

23 | 1B-15-04, DESA DELIMA, LORONG SEMARAK API 2, BANDAR BARU AYER ITAM,11500, PULAU | PENDING | 3 BEDROOM APARTMENT | 64 SQM | FREEHOLD | 117,000.00 |

24 | 1B-5-9,DESA DELIMA,LORONG SEMARAK API 2,,BANDAR BARU AIR ITAM,11500 | PENDING | 3 BEDROOM APARTMENT | 64 SQM | FREEHOLD | 110,000.00 |

25 | 4C-5-17,LORONG SEMARAK API 1,BANDAR BARU AYER ITAM,11500 PULAU | PENDING | 2 BEDROOM FLAT | 47.6SQM | LEASEHOLD | 54,675.00 |

26 | 4E-16-19, LORONG SEMARAK API SATU, BANDAR BARU AIR ITAM, 11500 | PENDING | 2 BEDROOM APARTMENT | 47.60SQM | FREEHOLD | 41,340.00 |

27 | 4C-11-8,LORONG SEMARAK API 1,BANDAR BARU AYER ITAM,11500 PULAU | PENDING | 2 BEDROOM FLAT | 47.6SQM | LEASEHOLD | 54,765.00 |

28 | 4E-12-22, LORONG SEMARAK API 1, BANDAR BARU AYER ITAM, 11500, PULAU | PENDING | 2 BEDROOM FLAT | 47.6 SQM | LEASEHOLD | 60,750.00 |

29 | 4A-5-24, LORONG SEMARAK API 1, BANDAR BARU AYER ITAM, 11500 AYER ITAM, | PENDING | LOW COST FLAT | 56.6 SQM | FREEHOLD | 58,500.00 |

30 | L-3-11,PANGSAPURI TANJUNG TOKONG FASA 4A,10470 TANJUNG TOKONG,PULAU | 13-Dec-11 | 3 BEDROOM APARTMENT | 60 SQM | LEASEHOLD | 130,000.00 |

31 | M-4-3, PANGSAPURI TANJUNG TOKONG FASA 4A, JALAN TANJUNG TOKONG, 10470 PULAU | PENDING | 3 BEDROOM APARTMENT | 60 SQM | LEASEHOLD EXPIRING 01.05.2074 | 101,250.00 |

32 | N-4-4,JALAN TANJUNG TOKONG,PANGSAPURI TANJUNG TOKONG,10470 | PENDING | 3 BEDROOM FLAT | 60 SQM | LEASEHOLD | 100,000.00 |

Back to Main Page: www.VulcanInternational.blogspot.com

Subscribe to:

Posts (Atom)