By Opalyn Mok January 02, 2013

GEORGE TOWN, Jan 2 ― Property investor clubs charging hundreds of ringgit in monthly membership are sprouting here as those on the hunt for higher yields are putting their money in Malaysia’s real estate market and spurring growth amid bleak economic reports, industry players say.

Property flipping ― a term coined to describe property bought at low prices and sold at a high profit ― appears to be the latest trend among investors, including foreigners, that is helping to lift blocks of buildings off the hands of developers and raise real estate prices.

Property expert Ho Chin Soon said such clubs are a new phenomenon due to rising interest in property investment amid uncertainty in the stock market.

He noted that previously there were only one or two of such clubs, but now there are five to six investors clubs in the country with a growing membership of between 400 and 600 members each.

“This could be due to investors’ perception that property is a legitimate and more stable investment to add to their portfolio,” the director of property information company Ho Chin Soon Research told The Malaysian Insider in a recent interview.

He agreed that, to a certain extent, these clubs could be one of many factors that is fuelling the property industry in the country.

The clubs work by buying properties en bloc from developers ahead of launches and then these offering to members at a discounted rate.

Potential property investors will fork out hundreds of ringgit monthly in membership fee just to get inside tips into the latest property projects pre-launch and opportunities to buy such properties with a bulk discount, said International Real Estate Federation (FIABCI) Malaysia committee member Michael Geh.

“These investors clubs are not only Malaysian-based ones as some are from Singapore,” he told The Malaysian Insider.

He warned that such clubs could create an artificial level of pricing for properties as genuine buyers would have little chance to buy units at the launch price and would have to purchase it from investors likely at an inflated price.

Geh and Ho, however, said the bulk-buying of properties by these investors would not create a property bubble that could burst in an economic downturn.

The duo said they felt the demand from genuine home buyers would be able to keep property prices afloat.

Jeffrey Lam, a partner in Smart Investors Club that boasts over a thousand members including from abroad, said the real estate market here is unlike those in Singapore, Hong Kong or China and still has room to expand with no danger of creating a bubble.

Lam said Malaysia’s property market growth was still in the single-digits and added that the Japanese, Chinese and Singaporeans were looking for opportunities to invest here.

“The demand for properties in Malaysia by home buyers, not only investors, is still strong and that is why more investors are getting into this,” he said.

He said an investor club member could stand to make a profit of a minimum RM25,000 up to RM100,000 for each investment into residential properties and up to millions for commercial properties.

“This is why more investors are going into property investment as the profit is good especially if they invest in the right type of properties,” he said.

Malaysia is seen as a budding real estate player, offering a stable market with good opportunities for opportunistic returns.

The national capital Kuala Lumpur was ranked fifth out of 22 cities with the best prospects in investment and development in the Asia-Pacific, according to the Emerging Trends In Real Estate Asia Pacific 2013 report by the US-based Urban Land Institute and PricewaterhouseCoopers (ULI-PwC), up 17th from last year.

KL gained favour for being “relatively stable but with good potential for opportunistic returns,” the report said.

The ULI-PwC report added: “The long-term prospects for the commercial property market are deemed by many to be strong, due to the success of the government’s Economic Transformation Programme in drawing foreign investment.”

But FIABCI’s Geh said not everyone that joins these clubs are guaranteed high returns. He added that property investment also comes with risks.

“These clubs will hold talks and seminars on property investments and then offer its members ‘special deals’ to buy into pre-launch projects but there are no guarantees that they could sell these investments later for a profit,” he said.

He advised those new to property investments to be cautious and not to put all their savings into the investment.

“Don’t forget, it can go either way just like any investment. If you put RM3 million into a property, you could stand to make a profit out of it later or you may just lose it all,” he said.

Source reference link: http://www.themalaysianinsider.com/malaysia/article/with-promise-of-real-estate-boon-property-investor-clubs-boom/

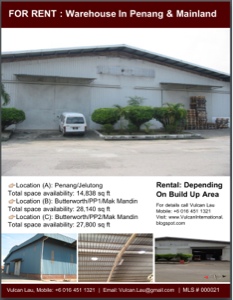

Picture below: The number of property investment collectives in Penang has grown by almost 300 per cent in recent years.—Picture by KE Ooi