The only site that provides you with detail information including factsheets, news, articles, photos about factory, warehouse property, commercial building for sale rent and to empower you with knowledge to buy sell let. Mobile: +6 016 451 1321, Location: Penang, MALAYSIA.

'LIKE' us to expand your property portfolio

Do check out our Facebook Business Page: www.facebook.com/VulcanInternationalPage. Please 'LIKE' our page.

Malaysia Office: www.tinyurl.com/MalaysiaOffice | Our Motto: You Call, We Match

Thursday, June 16, 2011

What is investment | Malaysia: Gross Rental Yields(GRY)

What is investment | Malaysia: gross rental yields

Last Updated: Oct. 26, 2010

[Districts researched]

Ampang, Ampang Hilir, Bangsar Baru, Bukit Kiara, Damansara Heights, Jalan Ampang, Kenny Hills,

KLCC (Kuala Lumpur City Centre), Mont Kiara, Sri Hartamas, Taman Tun Dr. Ismail, Ukay Heights

Source: Global Property Guide

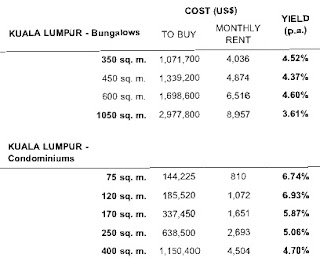

Condominium prices in Kuala Lumpur are reasonable at between US$1,500 to US$3,000 per square metre (sq. m.)

The extraordinary stability of residential property prices in Malaysia – rising in some years by 2% or 3%, falling in other years by a few per cent – means that the observer is never shocked by a sudden boom or price-collapse. In inflation-adjusted terms, prices have been almost completely stable for the past 15 years.

Given that Malaysia is a large place and relatively thinly populated, there are obvious limits to capital appreciation prospects (arguably, except in ‘dormitory town’ areas for neighbouring Singapore).

Therefore, the prime attraction of property ownership in Kuala Lumpur is income. Gross rental yields have fallen somewhat over the past year. Rents have not kept pace as nominal prices have risen. Yet the decline has been gentle, almost invisible. The 120 sq. m. condominium category remains the best-paying investment, with gross returns of 7%, but last year, our researchers found that rental yields averaged over 8% for this size.

Gross rental yields on condominiums generally range from 5% to 7%. Bungalows have lower yields, typically just over 4%.

Back to Main Page: www.VulcanInternational.blogspot.com

Last Updated: Oct. 26, 2010

[Districts researched]

Ampang, Ampang Hilir, Bangsar Baru, Bukit Kiara, Damansara Heights, Jalan Ampang, Kenny Hills,

KLCC (Kuala Lumpur City Centre), Mont Kiara, Sri Hartamas, Taman Tun Dr. Ismail, Ukay Heights

Source: Global Property Guide

Condominium prices in Kuala Lumpur are reasonable at between US$1,500 to US$3,000 per square metre (sq. m.)

The extraordinary stability of residential property prices in Malaysia – rising in some years by 2% or 3%, falling in other years by a few per cent – means that the observer is never shocked by a sudden boom or price-collapse. In inflation-adjusted terms, prices have been almost completely stable for the past 15 years.

Given that Malaysia is a large place and relatively thinly populated, there are obvious limits to capital appreciation prospects (arguably, except in ‘dormitory town’ areas for neighbouring Singapore).

Therefore, the prime attraction of property ownership in Kuala Lumpur is income. Gross rental yields have fallen somewhat over the past year. Rents have not kept pace as nominal prices have risen. Yet the decline has been gentle, almost invisible. The 120 sq. m. condominium category remains the best-paying investment, with gross returns of 7%, but last year, our researchers found that rental yields averaged over 8% for this size.

Gross rental yields on condominiums generally range from 5% to 7%. Bungalows have lower yields, typically just over 4%.

Back to Main Page: www.VulcanInternational.blogspot.com

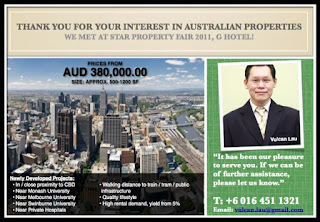

Penang Property Fair | Star Property Fair 2011 - Completed

We are most delighted to inform you that once again the successful annual The Star Property Fair 2011 is back.

THE STAR, Malaysia’s leading English daily in collaboration with Henry Butcher Malaysia Penang, will be organising its annual Penang Property Fair: The Star Property Fair 2011 from 21 – 24 July, 2011. This annual property exhibition offers prospective property investors with one of the largest showcase of choice properties in Penang.

The fair promises to be more exciting this year. The exhibition will showcase new and “yet to be revealed” real estate developments and the ever popular free public forums. A round table discussion with industry is being organized as a prelude to the fair.

Since its inception in 2003, The Star’s Property Fair has continued to reinvent itself to be the most sought after event in the Northern region of Malaysia.

With new elements being introduced annually, the most prestigious fair in the Northern region never failed to dazzle both exhibitors and visitors alike.

With the overwhelming success of The Star’s Property Fair last year, the committee of the event aims higher to include different dimension to the fair.

Amongst other, the following are in our plan:

- A more comprehensive showcase of foreign properties

- Talks and forums pertaining to investment in foreign properties

As such we would like to invite your esteemed organisation to join us in this venture to make the fair another successful one.

Why are we incorporating this foreign “element”?

- It will be the first of its kind in the Northern region. Never, has any fair dedicate a section solely for foreign properties.

- Penangnites are prudent and ardent property investors.

- There is an influx of people in Malaysia, particularly Penang, who are hungry for information pertaining to foreign properties as some have children studying overseas while others are thinking of migration or just for pure investment purposes.

- We intend to act as a gateway for international players to penetrate the regional market and a window for local investors to view global properties.

Why were we successful?

- New elements introduced yearly to make the fair exciting and refreshing.

- Most publicised property fair in the Northern region. Extensive publicity in various media to reach out to a wide range of market:

o PRINT: The Star newspaper – the leading English daily in Malaysia.

o RADIO: Three leading radio stations – RedFM (English), Suria FM (Malay) and 988 (Chinese).

o ONLINE: StarProperty Portal and Star Online.

- Informative talks/forum by renowned gurus and professionals in the industry.

- Exciting games/contest with lots of prizes to be won.

AT A GLANCE

Date: 21 – 24 July, 2011

Venue: G Hotel & Gurney Plaza

Moved to the more affluent G Hotel and Gurney plaza in 2009 based on the change in tastes, preferences, values and attitudes of today’s consumers.

Exhibitors: Approximately 20 of the biggest names in Penang’s property market in 2010.

Visitors: More affluent visitors.

Estimated 10,000 per day in 2010.

Back to Main Page: www.VulcanInternational.blogspot.com

Wednesday, June 15, 2011

Current Singapore property market

Hongkong Land eyes further growth in Singapore, Indonesia

Dated: June 14, 2011Hongkong Land, the biggest landlord in Hong Kong’s central district and a part of the Jardine Matheson Group, said upside for office rentals in the city centre was limited as already sky-high rents could force companies to relocate to more affordable areas.

However, a report last week by real estate agency Savills said that it expected office rents in the heart of Hong Kong will rise as much as 55 per cent this and next year combined. Non-core districts will see office rents rise by 40 per cent during the same period.

Hong Kong has replaced London as the most expensive office location in the world, DTZ said, with rents for prime office space going at US$1,877 (RM5,690) per square metre a year, compared to US$952 per square metre a year in Singapore.

“We will still continue to see a little bit of upside but it becomes a question of affordability,” Robert Garman, an executive director at Hongkong Land said in an interview.

As a result, Hongkong Land is seeking to expand more in overseas countries such as Singapore, where the government has been more aggressive in reclaiming land around its central business district.

“Singapore is a very key market and in the future you’re going to see a lot more growth here because you’ve got a large reservoir of land that the government has created to sustain that growth,” Garman said.

He added that he expects Singapore’s office sector to see more rental upside over the next 12-18 months as compared to Hong Kong, fuelled by strong demand from the financial services and commodities sectors.

“Rents in Singapore are still relatively inexpensive compared to Hong Kong so people will look to future growth here. There’s also more availability of good quality office in Singapore, and that’s why we’re more keen on expanding here,” Garman said.

In Singapore, Hongkong Land owns stakes in developments such as the Marina Bay Financial Centre and One Raffles Quay, which it jointly developed with Keppel Land and Cheung Kong.

About 15-20 per cent of Hongkong Land’s total gross asset value comes from its Singapore properties, but Garman said he expects this to increase in the coming years.

It has about 1.3 million square feet of completed properties in Singapore and another 400,000 square feet of upcoming office space next year.

After Hongkong Land launches the third tower at Marina Bay Financial Centre in April, it will have no further commercial projects in its pipeline but it plans to acquire more land that are in close proximity to its existing developments in Singapore’s central business district, said Garman.

However, he did not rule out developing offices outside of Singapore’s downtown area if their existing tenants, such as banks, require more office space in non-prime areas for back-end services.

Besides Singapore, Hongkong Land is also planning to develop more sites in Jakarta, Indonesia, as demand for office space is expected to grow with the country’s booming oil and gas and commodities industries.

“Indonesia’s market has picked up significantly, so we’d like to expand our business there,” said Garman.

Hongkong Land has acquired a 50 per cent stake in Jakarta Land, which owns 800,000 square feet of prime office space in the city’s central business district.

“I see all the sectors there expanding. In the field of oil and gas and commodities, we’re seeing quite a large amount of growth. We’re also seeing local banks improving their accommodation in Jakarta,” Garman added. – Reuters

Back to Main Page: www.VulcanInternational.blogspot.com

Sunday, June 12, 2011

I'm in Twitter, Facebook and YouTube...Latest: In Google+

Latest in Google+ under pseudonym Vulcan Lau. Google+ is under invitation only(the same with gmail account). If you want Google+ account invitation do email me at Vulcan.Lau@gmail.com

This served to inform you that I'm officially in Twitter under VulcanLau and to go to Twitter do click the link on right hand column under FOLLOW ME ON TWITTER(press TWEET). Alternatively you could click: twitter.com/@vulcanlau to follow my postings.

For Facebook under "Vulcan International Real Estate Investors Club." To go to Facebook do click the link on right hand column under WITH ME ON FACEBOOK(press Facebook). Alternatively you could click: www.tinyurl.com/VulcanIn to follow my Facebook messages and most importantly share your ideas. I would like to hear from you.

For YouTube under "Vulcan International's Channel." To enjoy YouTube do click the link on right hand column under VULCAN INTERNATIONAL'S CHANNEL(press Movie Channel). Alternatively you could click: www.youtube.com/VulcanInternational to enjoy movie channel. Select your relevant movie to view.

Note: If you're using Mobile version you might not be able to see the links, you need to change to Web version by scrolling all the way down. This blog is now able to cater for Mobile version and Web version.

This served to inform you that I'm officially in Twitter under VulcanLau and to go to Twitter do click the link on right hand column under FOLLOW ME ON TWITTER(press TWEET). Alternatively you could click: twitter.com/@vulcanlau to follow my postings.

For Facebook under "Vulcan International Real Estate Investors Club." To go to Facebook do click the link on right hand column under WITH ME ON FACEBOOK(press Facebook). Alternatively you could click: www.tinyurl.com/VulcanIn to follow my Facebook messages and most importantly share your ideas. I would like to hear from you.

For YouTube under "Vulcan International's Channel." To enjoy YouTube do click the link on right hand column under VULCAN INTERNATIONAL'S CHANNEL(press Movie Channel). Alternatively you could click: www.youtube.com/VulcanInternational to enjoy movie channel. Select your relevant movie to view.

Note: If you're using Mobile version you might not be able to see the links, you need to change to Web version by scrolling all the way down. This blog is now able to cater for Mobile version and Web version.

Back to Main Page: www.VulcanInternational.blogspot.com

Subscribe to:

Posts (Atom)